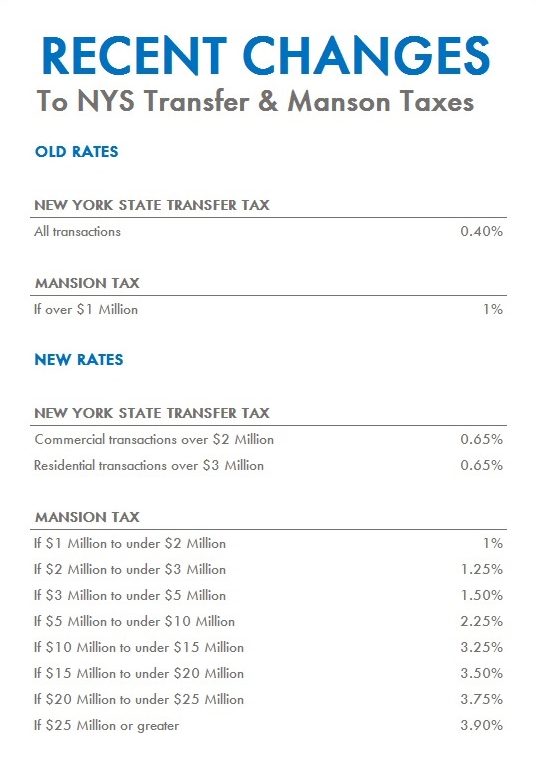

The New York State Legislature recently announced changes to the Purchaser’s Transfer Tax (commonly known as the “Mansion Tax”), and the New York State Transfer Tax, which were passed as part of the 2020 budget. The changes to the Mansion Tax will affect any real estate closings taking place after July 1, 2019, unless the transaction was in contract prior to April 1, while the changes to the NYS Transfer Tax are effective beginning April 1.

In order to help our clients make sense of the new changes, we compiled a handy chart showing how the changes to the tax apply. We hope it helps, and feel free to contact us if you have any questions. Are you a currently involved in a transaction and wondering whether or not these rates will apply to you? Good news – we have another handy chart for your reference here!